Foreign Trade Zone

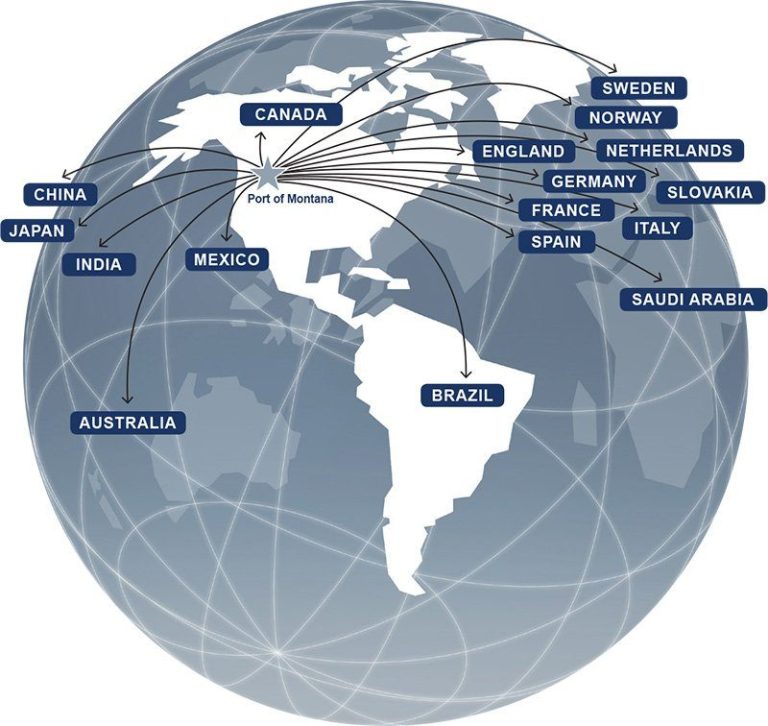

The Port of Montana is the only Foreign Trade Zone (FTZ) General Purpose Warehouse within a five-state radius in the Rocky Mountain Region of the United States. FTZs are designated areas within the United States that are considered outside U.S. customs territory. An FTZ ultimately allows companies to decrease or eliminate costs on imports, avoid duties on direct exports and product processing fees and wait for product quota restrictions to be lifted prior to paying an import duty on a finished product entering the U.S. market.

- Improved cash flow - duties and taxes are not payable until merchandise leaves the FTZ and is distributed inside United States Commerce

- Unlimited time for storage - goods can be stored for an unlimited period of time without having to pay an import duty

- Re-exportation without import duty - products stored or manufactured in the FTZ using foreign materials may be re-exported without any import duty being assessed on the foreign materials

- No customs duties imposed on processing, testing, assembly, repackaging, inspecting and relabeling - all can be conducted within the FTZ and the product can be re-exported or destroyed without ever incurring customs duties

- Enhanced consumer convenience - customers can inspect and sample foreign goods before purchasing and paying a duty

- No penalties -refusal of or repair to damaged goods can take place duty and quota free

- No quota restrictions - importing directly into the FTZ allows goods to be held until the next quota period or until the best price can be obtained in the U.S. market

- Increases efficiency and effectiveness - relative to storage, security and delivery of goods

If you are looking to cut costs on your imports/exports, see how using the Port of Montana's Foreign Trade Zone can reduce your overhead and improve your cash flow. Contact us for a quote today.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details and accept the service to view the translations.